Large corporate and government vehicle fleets are increasingly turning to plug-in vehicles to take advantage of dramatically lower fuel, operating and maintenance costs. For the fleet manager, however, the EV infrastructure world is a lot more complicated than it is for gas or CNG vehicles, which can use a single refueling depot.

In spite of some adoption challenges, many expect the EV fleet market to grow quickly – particularly in the federal, state, and local government spheres. In March 2015, for example, President Obama signed an executive order directing the federal government to cut its greenhouse gas emissions by 40 percent from 2008 levels by 2025. As a part of this plan, zero-emission or plug-in hybrid vehicles are to make up 20 percent of government agencies’ fleets by 2020, and 50 percent by 2025. Agencies will also have to ensure that there is sufficient charging infrastructure. This presents a sizable opportunity for companies that can develop products that ease the transition for fleet managers.

Recently ChargePoint announced upgrades to its Fleet Plan, including revamped hardware and an upgraded analytics platform. Charged chatted with Michael Jones, ChargePoint’s VP of Sales, to learn more about the updates.

Charged: How does ChargePoint’s fleet analytics platform differ from other commercial applications, like workplace charging?

Jones: Our traditional analytics are focused on either the station owner or the driver, but from a fleet operator’s perspective you need to see both sides. So there is a lot more information in this software that shows how a fleet is performing.

With EVs, the refueling options are a lot more dynamic, so fleets will need tools to track all of the possible charging scenarios. A manager is going to have to deal with vehicles charging at a central depot, other offices, out in public, at employees’ homes, etc. We believe this is what will separate ChargePoint’s fleet solution from the other options – we have a comprehensive charging product line and can tie everything together with analytics.

We also just announced the new Fleet Card. It’s basically an access card for public charging that can be paired with a vehicle and allow any driver to charge in public at the independently owned and operated ChargePoint stations. Then it delivers all the financial and energy information and control back to the fleet operator.

We’re also focused on building a system that is scalable as fleets go from having a few plug-in vehicles to having hundreds. And a big part of the scalability is energy management.

We think this product really shines in all the energy features like scheduled charging and panel sharing.

One exciting new feature we launched that customers are excited about is called panel sharing. This will dynamically distribute the power output to all of the vehicles connected to the same electric service panel in a way that will not exceed any panel’s capacity.

Say you have panel capacity for only 5 stations and you need to support 10 fleet cars plugged in simultaneously. You can easily over-subscribe the panel and put in 10 stations without a service upgrade.

It can save you quite a bit of money in upstream electrical distribution upgrades. And it gives a lot of flexibility for deployments, which I think is going to be very important to fleet managers. That’s the magic of the software in the cloud, basically you say what the capacity of the panel is and it will figure out how to best distribute that load to the cars.

The software allows you to shift charging to off-peak periods when electricity rates are lowest and avoid demand charges. If you think about a large fleet of vehicles, these features could literally save tens of thousands of dollars in a given year – which could pay for the infrastructure.

The system also has a lot of other great features like access control and notifications. You can send messages to operational staff working at different times so they can optimize to have as many cars charging as possible.

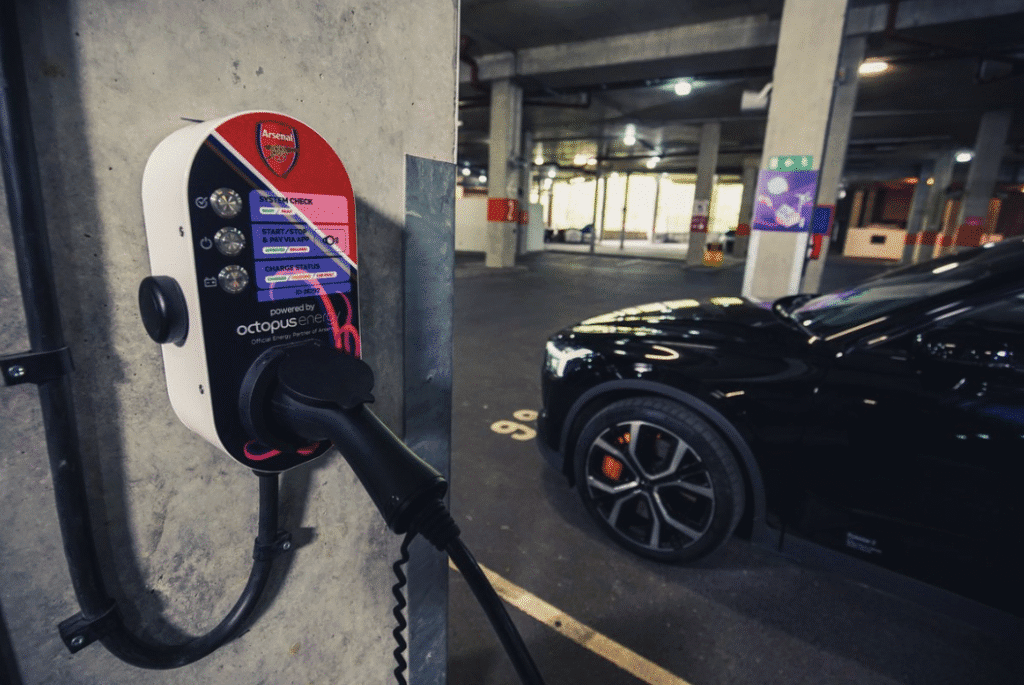

Charged: Can you tell us about the fleet-specific hardware? The EVSE itself appears to be based on the ChargePoint Home, a Wi-Fi-enabled residential charger that you launched last year. Is that correct?

Jones: It shares the same platform design, or form factor, but the internal electronics are slightly different in a few ways. For example, it has an RFID-access-controlled system, it’s a little more ruggedized, and it has more mounting options for the environments it’s going to be operating in. It’s designed for what we call behind-the-fence applications.

Basically it’s a WiFi-enabled RFID-access-controlled system that has both single- and dual-station configurations, wall and pedestal mounts and optional cord management features.

The WiFi is embedded in all the units to communicate locality, and then there is a WiFi -to-cellular gateway. It’s a small box that allows fleet charging in areas that don’t typically have WiFi coverage, like subterranean garages. We’ve seen wireless barriers in some locations, so this cellular gateway allows easy access to the cloud.

Charged: Will the hardware be owned by the fleet operators or by ChargePoint?

Jones: We sell the hardware to the fleet operator, similar to the way we work with most commercial charging installations where the site host owns the chargers and sets the pricing usage policies. Then our backend analytics platform is available on subscription plans. That can be prepaid for multiple years or paid for on an annual basis, whichever the operator prefers.

We also have a program called Assure that is basically complete parts and labor services. This comes with guarantees for uptime, for active monitoring of response times to fix problems. It takes away the burden of supporting the infrastructure across multiple properties or hosts or regions, and allows owners a reliable guarantee that the service is going to be up and working.

One of the things we’ve really been analyzing and building as a company is to make sure that a driver – no matter where they go – has the confidence that charging is going to be available to them. So they don’t have to think about it. And the same goes for fleet managers. They know that the infrastructure is going to be taken care of and it’s not going to cause new burdens on their operation.

The ecosystem for EVs offers fleets some great opportunities, but also new burdens (which our Fleet Plan is aiming to eliminate). The obvious opportunities are the cost savings from using plug-in vehicles, but there is also the opportunity to track and manage energy usage at a level not possible with the traditional fueling model. With our comprehensive product line you can track charging at home, at the fleet depots, and in public – including DC fast charging. We allow them to tie that entire ecosystem together and manage the costs and, at the same time, we can remove the burden of managing that network.

I think that’s going to be very important going forward, to have that kind of breadth and think about all the different ways that a fleet of vehicles is going to be used.

Charged: It seems like a lot of the short-term growth in EV fleets is driven by government initiatives. Do you see private fleets adopting them as well?

Jones: We’re still in the early stages for both public and private, but it’s changing quickly.

I think that the private fleets are going to move towards plug-ins a little slower. The majority of them tend to be that medium- and heavy-duty type of fleet. The large light-duty fleets on the private side are found for things like pharmaceutical sales, for example. Basically, employees get a credit to go and buy a car. So those programs will migrate to electric as more consumer-friendly cars come into the market. It’s going to mirror the consumer market because the employee gets a credit for a car and then chooses what they like from a wide selection.

Then we certainly see a fair amount of activity for medium- and heavy-duty private fleets like work trucks and shuttle buses.

On the public side, states like California and New York are leading the way with ZEV mandates and fleet action plans. There we’re seeing a lot of early adoption, starting with the city, state and county fleets. Also at the federal level, with the White House directive to move toward EVs there is now a lot of activity. For example, the Navy in California is getting ready to acquire 500 EVs and put them on 18 bases. So it’s things like that where the scale is pretty dramatic. We’re still in the early stages but we’re seeing rapid growth.

This article originally appeared in Charged Issue 25 – May/June 2016. Subscribe now.